In the AI-powered, data-saturated reality of 2025, Chief Marketing Officers face a paradox: they have more tools than ever to measure performance, yet they still struggle to prove marketing’s full strategic value.

ROI and ROAS remain popular, but they capture only the short-term wins. They don’t account for the brand equity built over years, the intellectual capital embedded in content libraries, or the competitive advantage of well-orchestrated customer relationships.

To close this accountability gap, marketing leaders need a holistic model—one that can articulate marketing’s role in enterprise value creation just as clearly as a CFO’s balance sheet communicates financial health.

That’s where the Marketing Balance Sheet comes in.

Why Marketing Needs a Balance Sheet

According to The CMO Survey (2023), only 22% of Fortune 1000 companies can effectively quantify marketing’s contribution to revenue. Gartner’s 2025 CMO Spend Survey paints an equally sobering picture: marketing budgets remain flat at 7.7% of company revenue, with 59% of CMOs reporting they still lack the funds to execute their strategies.

Without a framework that quantifies both short-term performance and long-term strategic assets, marketing remains vulnerable—perceived as a cost center, not an investment.

The Framework

The Marketing Balance Sheet adapts financial accounting principles to marketing strategy. Its core equation mirrors the financial world:

Marketing Assets – Marketing Liabilities = Marketing Equity

Just as a traditional balance sheet offers a snapshot of financial health, this model provides a structured view of marketing’s strategic position.

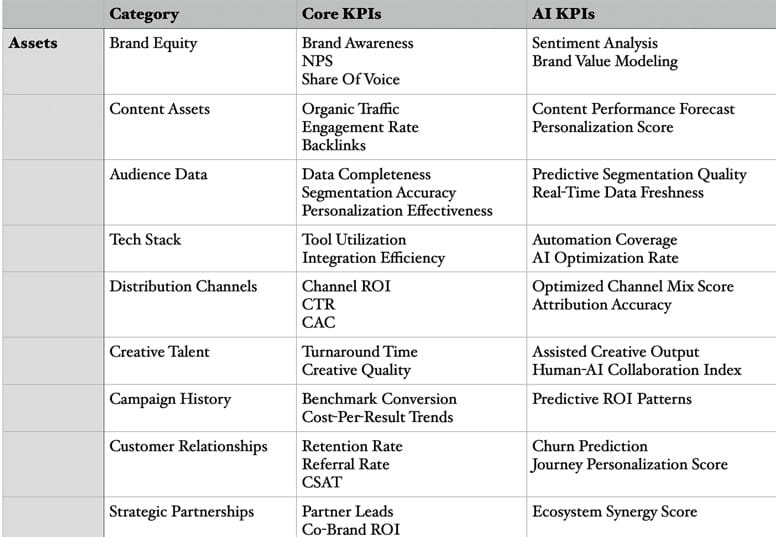

1. Marketing Assets: The Engines of Future Value

Assets are the resources and investments that fuel future growth. Examples include:

- Brand Equity – Trust, loyalty, and premium pricing power

- Content Assets – Evergreen articles, videos, and thought leadership

- Audience Data – Segmentation, behavioral insights, and personalization capabilities

- Distribution Channels – Owned, earned, and paid platforms with proven reach

- Tech Stack – CRM, automation, analytics, and AI-driven platforms

- Creative Talent – The strategists and creators who translate vision into market impact

- Campaign History – Institutional memory that prevents reinvention of the wheel

- Customer Relationships – Deep connections that drive retention and advocacy

- Strategic Partnerships – Alliances that extend reach and credibility

AI’s role: From real-time brand sentiment tracking to predictive customer modeling, AI amplifies each asset’s value and scalability.

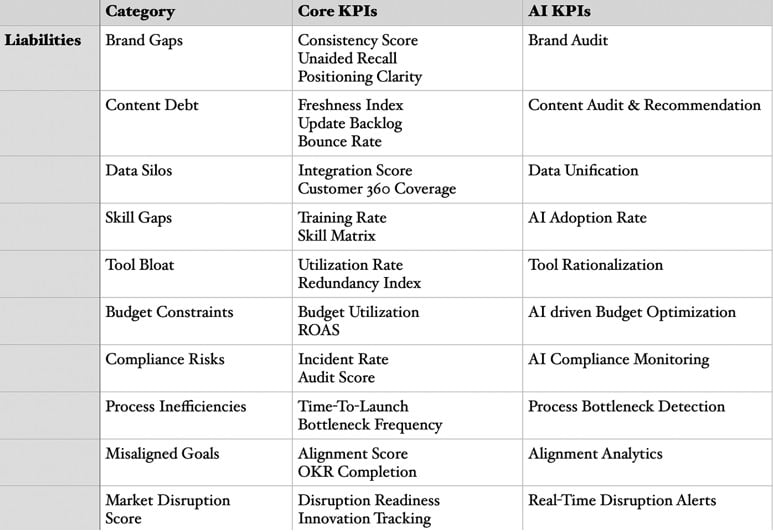

2. Marketing Liabilities: The Hidden Drains on Performance

Liabilities are the inefficiencies and risks that erode marketing’s returns. These include:

- Brand Gaps – Weak positioning or inconsistent messaging

- Content Debt – Outdated or underperforming material

- Data Silos – Fragmented systems that block a unified customer view

- Skill Gaps – Missing expertise for modern marketing execution

- Tool Bloat – Redundant or poorly integrated technologies

- Budget Constraints – Insufficient or misallocated resources

- Compliance Risks – Regulatory exposure in data privacy and communications

- Process Inefficiencies – Bottlenecks that slow time-to-market

- Misaligned Goals – Disconnects between marketing and business priorities

- Market Disruption Exposure – Vulnerability to competitive or consumer shifts

AI’s role: Automated audits, predictive disruption modeling, and cross-system data unification can shrink liabilities dramatically.

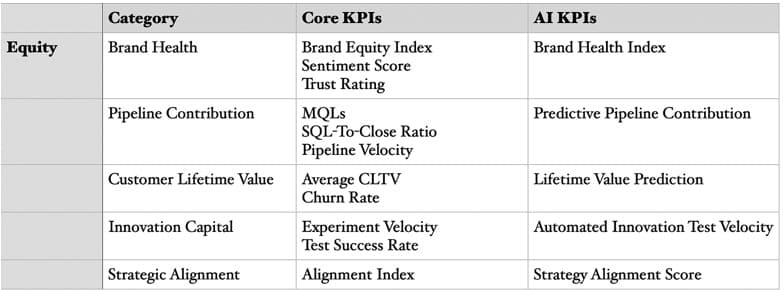

3. Marketing Equity: The Net Contribution to Enterprise Value

Equity is the “net worth” of your marketing function—the long-term impact after accounting for liabilities. Key dimensions include:

- Brand Health – Perception, trust, and affinity

- Pipeline Contribution – Revenue influence and velocity

- Customer Lifetime Value (CLTV) – The enduring value of retained customers

- Innovation Capital – The organization’s adaptability and learning speed

- Strategic Alignment – Direct linkage between marketing activity and corporate strategy

The AI Multiplier Effect

Artificial intelligence is not merely another technology tool; it fundamentally transforms how marketing creates and measures value. The Marketing Balance Sheet framework becomes particularly powerful when enhanced by AI capabilities:

For Assets:

- Content creation and personalization at unprecedented scale

- Real-time optimization of channel performance

- Predictive modeling of customer lifetime value

- Automated brand monitoring across all touchpoints

For Liabilities:

- Early detection of brand inconsistencies

- Automated content auditing and refreshing

- Intelligent data integration across silos

- Predictive market disruption modeling

For Equity:

- Multi-touch attribution that captures full-funnel impact

- Predictive modeling of lifetime value drivers

- Real-time optimization of marketing mix modeling

- Automated competitive intelligence

Implementation Roadmap

- Baseline Assessment

- Audit existing marketing assets and quantify their current value

- Identify and prioritize key liabilities for immediate attention

- Establish initial equity measures as performance benchmarks

- Data Infrastructure

- Connect siloed systems to enable holistic measurement

- Implement tracking for new KPIs identified in the framework

- Establish a regular reporting cadence aligned with financial cycles

- Strategic Realignment

- Adjust budget allocations based on asset potential and liability reduction

- Develop an AI enhancement roadmap, starting with the highest-impact opportunities

- Create communication materials to socialize the framework with leadership

- Continuous Optimization

- Regularly update the Marketing Balance Sheet (quarterly recommended)

- Track year-over-year trends in marketing equity development

- Refine measurement methodologies based on emerging capabilities

Connecting to Financial Outcomes

To maximize its strategic value, the Marketing Balance Sheet must link directly to the financial metrics that drive executive decision-making:

- Revenue Growth Attribution: Show exactly how marketing drives sales. Use AI to track customer touchpoints and see which marketing activities actually lead to purchases. This helps prove the value of things like content and brand-building that were previously hard to measure.

- Margin Enhancement: Measure how a strong brand lets you charge higher prices. When customers trust your brand, they’re willing to pay more, which means you make more profit on each sale.

- Valuation Multiple Impact: For public companies, a strong brand makes your company worth more to investors. When Wall Street sees you have loyal customers and a competitive edge, they’ll pay more for your stock compared to your earnings.

- Risk Mitigation Value: Calculate how marketing provides “insurance” against market downturns. Things like diverse marketing channels and strong customer relationships make your revenue more stable and predictable, which has real financial value.

Why This Matters for CMOs

A Marketing Balance Sheet changes the CMO conversation in the boardroom. It:

- Links marketing activity to financial outcomes like revenue growth, margin improvement, and valuation multiples

- Positions marketing as a strategic growth engine, not a discretionary expense

- Provides a common language for marketing and finance, improving budget credibility

In the AI era, the winners will be the marketing leaders who can not only act fast but account for their impact.